QuickLinks-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | ||

Filed by a Party other than the Registrant | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to | |

TRANS WORLD ENTERTAINMENT CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i) | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

TRANS WORLD ENTERTAINMENT CORPORATION

38 CORPORATE CIRCLE

ALBANY, NEW YORKCorporate Circle

Albany, New York 12203

(518) 452-1242

------------------------

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

---------------------

Date and | Wednesday, June | |

Place | The Desmond 660 Albany Shaker Road Albany, New York 12211 | |

Items of | (1) To elect | |

(2) To approve the | ||

(3) | ||

Record | Shareholders of record as of | |

Proxy | A proxy and return envelope, requiring no postage if mailed in the United States, are enclosed for your convenience. Please complete and return |

| By order of the Board of Directors, | ||

John J. Sullivan, Secretary |

May 11, 2005

TRANS WORLD ENTERTAINMENT CORPORATION

38 CORPORATE CIRCLE

ALBANY, NEW YORKCorporate Circle

Albany, New York 12203

(518) 452-1242

------------------------

This Proxy Statement is furnished to the shareholders of Trans World Entertainment Corporation, a New York corporation (the "Company"), in connection with the solicitation of proxies by the Board of Directors for use at the Company's Annual Meeting of Shareholders of the Company to be held on June 20, 2002,8, 2005, and any adjournment or adjournments thereof. A copy of the notice of annual meeting accompanies this Proxy Statement. It is anticipated that the mailing of this Proxy Statement and the form of proxy/voting instruction card will commence on May 23, 2002.

11, 2005.

The Company has only one class of voting securities, its Common Stock,common stock, par value $.01 per share (the "Common Stock"). On May 6, 2002,April 22, 2005, the record date, 40,751,54032,879,392 shares of Common Stock were outstanding. Each shareholder of record at the close of business on the record date will be entitled to one vote for each share of Common Stock owned on that date as to each matter presented at the meeting.

QUORUM AND TABULATION OF VOTES

The By-Laws of the Company provide that a majority of the shares of Common Stock issued and outstanding and entitled to vote, present in person or by proxy, shall constitute a quorum at the Annual Meeting of Shareholders of the Company. Votes at the Annual Meeting will be tabulated by an inspector from Mellon Investor Services appointed by the Company. Shares of Common Stock represented by a properly signed and returned proxy are considered as present at the Annual Meeting for purposes of determining a quorum.

Brokers holding shares for beneficial owners must vote those shares according to the specific instructions they receive from the owners. If specific instructions are not received, however, brokers may vote these shares in their discretion, depending upon the type of proposal involved.

Pursuant to the Company's By-Laws, directors of the Company will be elected by a favorable vote of a plurality of the shares of Common Stock present and entitled to vote, in person or by proxy, at the Annual Meeting.

Under New York law, abstentions and broker non-votes will have no effect on the outcome of the election of Directors at the Annual Meeting. Brokers have discretionary authority to vote on the election of directors.Directors. If a properly signed proxy form is returned to the Company by a shareholder of record and is not marked, it will be voted "FOR" the proposals set forth herein as Item 1 Item 2 and Item 3.2. The enclosed proxy may be revoked by a shareholder at any time before it is voted by the submission of a written revocation to the Company, by the returnsubmission of a new proxy to the Company, or by attending and voting in person at the Annual Meeting.

The only persons known to the CompanyBoard of Directors to be the beneficial owners of more than five percent of the outstanding shares of the Common Stock as of May 6,

2002,April 22, 2005, the record date, are indicated below:

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||

|---|---|---|---|---|---|---|

| Robert J. Higgins | 15,342,479 | (1) | 46.7 | % | ||

| 38 Corporate Circle | ||||||

| Albany, New York 12203 | ||||||

| Van Kampen Asset Management Company | 3,451,962 | (2) | 10.5 | % | ||

| 1585 Broadway | ||||||

| New York, New York 10036 | ||||||

| Dimensional Fund Advisors | 2,894,123 | (3) | 8.8 | % | ||

| 1299 Ocean Avenue, 11th Floor | ||||||

| Santa Monica, California 90401 | ||||||

- 1)

- Information is as of

May 6, 2002,April 22, 2005, as provided by the holder. Includes 2,900,000 shares that may be acquired within 60 days of April 22, 2005, 50,550 shares owned by the wife of Robert J. Higgins and37,500137,500 shares owned by a foundation controlled by Robert J. Higgins, and excludes769,762767,761 shares owned by certain other family members of Robert J. Higgins who do not share his residence. Mr. Higgins disclaims beneficial ownership with respect to those shares owned by family members other than his wife. - 2)

- Based on

Schedule 13FForm 13G, filed February14, 200216, 2005, byStephen Feinberg.Morgan Stanley and Van Kampen Asset Management Inc. - 3)

Information as of April 29, 2002, as provided by the holder. 4) - Based on

Schedule 13F,Form 13G, filed February14, 20029, 2005, byCramer Rosenthal McGlynn. 5) Based on Schedule 13F, filed February 12, 2002 by Merrill Lynch and Company.Dimensional Fund Advisors.

Mr. Higgins, who beneficially owns 13,275,15015,342,479 shares of Common Stock as of the record date (approximately 32.6%46.7% of all outstanding shares), has advised the Company that he presently intends to vote all of his shares for the election of the nominees for director named under "Item 1-ELECTION1—ELECTION OF DIRECTORS" and in

favorfor approval of the adoption of proposals (2) and (3).

2

ITEM"Item 2—APPROVAL OF THE LONG TERM INCENTIVE AND SHARE AWARD PLAN."

The Board of Directors currently intends to present forto the meeting the election at the

Annual Meeting threeof two Class II directors, each to hold office (subject to the Company's By-Laws) until the 20052008 Annual Meeting of Shareholders and until his or her respective successor has been elected and qualified and one Class III director to hold office (subject to the Company's By-Laws) until the 2006 Annual Meeting of Shareholders and until his or her respective successor has been elected and qualified. Directors of the Company will be elected by a plurality vote of the outstanding shares of Common Stock present and entitled to vote at the meeting.

If any nominee listed below should become unavailable for any reason, which management does not anticipate, the proxy will be voted for any substitute nominee or nominees who may be selected by the ChairmanNominating and Corporate Governance Committee of the Board prior to or at the meeting or if no substitute is selected prior to or at the meeting, for a motion to reduce the membership of the Board to the number of nominees available. The information concerning the nominees and their security holdings has been furnished by them to the Company.

NOMINEES FOR ELECTION AS DIRECTORS

GEORGE W. DOUGAN, has been a member of the Board of

Nominees for Election as Directors of Banknorth

Group, Inc. since January 1, 1999. From January 1999 to May 2001, Mr. Dougan

served as Vice Chairman of Banknorth Group, Inc. Mr. Dougan was Chief Executive

Officer and a member of the Board of Directors of Evergreen Bancorp Inc. from

March 1994 to December 1998, and Chairman of the Board from May 1994 to

December 1998. Mr. Dougan was the Chairman of the Board and Chief Executive

Officer of the Bank of Boston--Florida from June 1992 to March 1994. Mr. Dougan

was also the Senior Vice President and Director of Retail Banking of The Bank of

Boston Massachusetts from February 1990 to June 1992.

MARTIN

Martin E. HANAKAHanaka has served as Chairman Emeritus of the Board of The Sports Authority, Inc. since June 2004. Mr. Hanaka was the Chairman of the Board of the Sports Authority from November 1999 until June 2004 and aswas its Chief Executive Officer sincefrom September 1998.1998 until August 2003. Mr. Hanaka joined the Sports Authority's Board of Directors in February 1998. From August 1994 until October 1997, Mr. Hanaka served as President and Chief Operating Officer of Staples, Inc. an office supply superstore retailer. Mr. Hanaka's extensive retail career has included serving as Executive Vice President of Marketing and as President and Chief Operating Officer of Lechmere, Inc. from September 1992 through July 1994, and serving in various capacities for 20 years at Sears Roebuck & Co., most recentlyat the end as Vice President in charge of Sears Brand Central. Mr. Hanaka is also a directorDirector of Wil-Mar Industries, Inc. (marketingSports Authority and distributing repair and maintenance

products) and Nature's Heartland (food retailing).

ISAAC KAUFMANBrightstar Corporation, a certified public accountantwireless wholesale distributor.

Isaac Kaufman, a Certified Public Accountant has been Chief Financial Officer and Senior Vice President of AdvanceAdvanced Medical Management Inc., a manager of medical practices and an outpatient surgical center, since September 1998. Mr. Kaufman was Executive Vice President and Chief Financial Officer of Bio Science Contract Production Corporation, a contract manufacturer of biologics and pharmaceutical products, from February 1998 to September 1998. Mr. Kaufman was the Chief Financial Officer of VSI Group, Inc., a provider of contract staffing and management services, from November 1996 to February 1998. Mr. Kaufman serves as directorDirector of Kindred Healthcare, Inc. (operates nursing centers and long-term acute care hospitals).

3

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH NOMINEE

FOR DIRECTOR NAMED ABOVE.

CONTINUING CLASS II DIRECTORS (TERMS EXPIRING IN 2003)

DEAN S. ADLER

Lori J. Schafer has been a principalserved as Vice President of Lubert/Adler Partners, LP, a limited

partnership investing primarily in under-valuedMarketmax, Retail Division of SAS, since October of 2003, when Marketmax was acquired by SAS. Prior to the SAS acquisition, Ms. Schafer served as Marketmax's Chairman, President and opportunistic real estateChief Executive Officer. She has directed Marketmax operations since 1996. Prior to her move into retail consulting and real estate-related ventures, since March 1997. For ten years prior thereto,

Mr. Adler was a principalsoftware development, Ms. Schafer held positions of increasing and co-head of the private equity group of CMS

Companies, which specialized in acquiring operating businesses and real estate

within the private equity market. Mr. Adler was also an instructordiverse responsibility at The Wharton School of the University of Pennsylvania. Mr. Adler serves on the Boards

ofProcter & Gamble Company, including assignments in brand management, sales and management information systems.

Upon election, Ms. Schafer will be appointed a Class III Director with her term expiring in 2006.

Continuing Class III Directors of Electronics Boutique, The Lane Company, US Franchise

Systems, Inc. and Developers Diversified Realty Corporation.

MICHAEL(terms expiring in 2006)

Michael B. SOLOWSolow is currently the Managing Partner of the Chicago office of Kaye Scholer LLP, an international law firm based out of New York City, where he has practiced since January 2001.2001 and is currently a member of the firm's Executive Committee and Co-Chairman of the Corporate Restructuring Practice Group. Prior to joining Kaye Scholer LLP, Mr. Solow was a Partner and Practice Manager for the Financial Services Practice at Hopkins & Sutter, a Chicago, Illinois law firm.

Mr. Solow is also a member of the Board of Directors for ChriskenChristen Residential Trust, Inc. and has previously served on other corporate boards, including Camelot Music, Inc.

CONTINUING CLASS

Edmond Thomas has been Managing Partner for The Evans Thomas Company, LLC and AXIS Capital Fund I, DIRECTORS (TERMS EXPIRING IN 2004)

ROBERTLP since 2000. The Evans Thomas Company and AXIS Capital Fund provide advisory services for retail, catalog and consumer goods companies along with investing in emerging growth retail companies. Prior to joining The Evans Thomas Company, Mr. Thomas was the President and Chief Operating Officer of The Wet Seal, Inc., a publicly held leading junior apparel retailer. He has also served in various positions with several other retailers, including Domain, Inc., Foxmoor Specialty Stores and Child World, Inc. In addition, Mr. Thomas is a Certified Public Accountant.

Continuing Class I Directors (terms expiring in 2007)

Robert J. HIGGINS,Higgins, Chairman of the Board, founded the Company in 1972, and he has participated in its operations since 1973. Mr. Higgins has served as President,Chairman and Chief Executive Officer and a director of the Company for more than the past five years. He is also the Company's principal shareholder. See "PRINCIPAL SHAREHOLDERS."

DR. JOSEPH

Dr. Joseph G. MORONEMorone has been President of Bentley College since August 1997. Previously, Dr. Morone was the Dean of Rensselaer Polytechnic Institute's Lally School of Management and Technology from July 1993 to July 1997. Prior to his appointment as dean, Dr. Morone held the Andersen Consulting Professorship of Management and was Director of the School of Management's Center for Science and Technology Policy. Before joining the School of Management in 1988, Dr. Morone was a senior associate for the Keyworth Company, a consulting firm specializing in technology management and science policy. Dr. Morone also served in the White House office of science and technology policy and spent 7 years at General Electric Company's Corporate Research and Development. Dr. Morone serves on the Boards of Directors of Tufts New England Medical Center, The Massachusetts High Technology Council and Albany International Corp.

4

EQUITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

Mark A. Cohen was the Chairman and Chief Executive Officer of Sears Canada Inc. from January 2001 to August 2004. Mr. Cohen joined Sears, Roebuck and Company as Senior Vice President, Merchandising in 1998. From December 1998 until August 1999 he served as Executive Vice President, Marketing before being promoted to Chief Marketing Officer and President, Softlines. Prior to joining Sears, Mr. Cohen was Chairman and CEO of Bradlees Department Stores from 1994 until 1998. Mr. Cohen has also held various positions at other retailers, including Federated Department Stores, Dayton Hudson Corporation, Gap Stores and Lord & Taylor.

Mr. Dougan has advised the Company that he has elected to retire from the Board of Directors on June 8, 2005, the end of his current term.

Equity Ownership of Directors and Executive Officers

The following table sets forth the beneficial ownership of Common Stock as of May 6, 2002,April 22, 2005, by each directorDirector and named executive officer of the Company and all directorsDirectors and executive officers as a group. All shares listed in the table are owned directly by the named individuals unless otherwise indicated therein. The Company believes that the beneficial owners have sole voting and investment power over their shares, except as otherwise stated or as to shares owned by spouses.

| Name | Positions With the Company | Age | Year First Elected as Director/ Officer | Direct Ownership | Shares that may be acquired within 60 days of April 22, 2005 | Total Shares Beneficially Owned | Percent of Class | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Robert J. Higgins | Chairman of the Board, Chief Executive Officer & President | 63 | 1973 | 12,442,479 | (1) | 2,900,000 | 15,342,479 | 46.7 | % | ||||||

| Mark A. Cohen | Director | 56 | 2003 | — | 3,750 | 3,750 | * | ||||||||

| George W. Dougan | Director | 65 | 1984 | 7,143 | (2) | 75,125 | 82,268 | * | |||||||

| Martin E. Hanaka | Director | 56 | 1998 | 9,698 | 32,437 | 42,135 | * | ||||||||

| Isaac Kaufman | Director | 58 | 1991 | 30,283 | 49,625 | 79,908 | * | ||||||||

| Dr. Joseph G. Morone | Director | 52 | 1997 | 7,286 | 10,625 | 17,911 | * | ||||||||

| Michael B. Solow | Director | 46 | 1999 | 9,198 | 26,452 | 35,650 | * | ||||||||

| Edmond Thomas | Director | 51 | 2003 | — | 3,750 | 3,750 | * | ||||||||

| Bruce J. Eisenberg | Executive Vice President—Real Estate | 45 | 1995 | 20,137 | 401,250 | 421,387 | 1.3 | % | |||||||

| Fred L. Fox | Executive Vice President—Merchandising and Marketing | 47 | 2002 | — | 90,000 | 90,000 | * | ||||||||

| John J. Sullivan | Executive Vice President, Chief Financial Officer and Secretary | 52 | 1995 | 100,468 | 281,250 | 381,718 | 1.2 | % | |||||||

| All directors and officers as a group (11 persons) | 12,626,692 | 3,874,264 | 16,500,956 | 50.2 | % |

- *

- Less Than 1%

- (1)

- Includes 50,550 shares owned by the wife of Robert J. Higgins and

37,500137,500 shares owned by a foundation controlled by Robert J. Higgins and excludes769,762767,761 shares owned by certain other family members of Robert J. Higgins who do not share his residence. Mr. Higgins disclaims beneficial ownership with respect to those shares owned by family members other than his wife.BOARD OF DIRECTORS MEETINGS AND ITS COMMITTEES - (2)

- Does not include 30,698 shares held in a trust. Mr. Dougan disclaims beneficial ownership with respect to shares owned by the trust.

Board of Directors Meetings and its Committees

The Board of Directors held 75 meetings during the 20012004 fiscal year. All of the directorsDirectors attended greater than 75% of the aggregate of: (i) the total number of meetings of the boardBoard of directors,Directors, and (ii) the total number of meetings held by all committees of the boardBoard on which such directorDirector served.

The Company has an Audit Committee of the Board of Directors whose members during the 20012004 fiscal year were: Isaac Kaufman (Chairman), Dr. Joseph G. Morone, Michael B. Solow and Joseph G. Morone.Edmond Thomas. These directorsDirectors are, in the opinion of the Board of Directors, "independent" (as defined under the standards of the National Association of

Securities Dealers)Nasdaq Stock Market) of management and free of any relationship that would interfere with their exercise of independent judgement as members of the audit

committee.Audit Committee. The Board of Directors has determined that Isaac Kaufman and Edmond Thomas are both independent and qualified as Audit Committee financial experts as such term is defined under the rules and regulations promulgated by the Securities and Exchange Commission and applicable to this Proxy Statement. The Audit Committee held 46 meetings during the 20012004 fiscal year. The Audit Committee's responsibilities consist of recommending the selection of independent auditors,accountants, reviewing the scope of the audit conducted by such auditors,accountants, as well as the audit itself, and reviewing the Company's audit activities and activities and matters concerning financial reporting, accounting and audit

procedures, related party transactions and policies generally. The Board of Directors has adopted a written charter for the Audit Committee.

The Company has a Compensation Committee of the Board of Directors, consisting solely of independent directors,Directors, whose members during the 20012004 fiscal year were: Martin E. Hanaka (Chairman), Isaac Kaufman andMark A. Cohen, George W. Dougan.Dougan and Isaac Kaufman. The Compensation Committee held 2 meetings during the 5

20012004 fiscal year. The Compensation Committee formulates and gives effect to policies concerning salary, compensation, stock options and other matters concerning employment with the Company. The Board of Directors has adopted a written charter for the Compensation Committee.

The Company has a Nominating and Corporate Governance Committee of the Board of Directors, consisting of independent Directors, whose members during the 2004 fiscal year were: Dr. Joseph G. Morone (Chairman), Mark A. Cohen, George W. Dougan, Martin E. Hanaka, Isaac Kaufman, Michael B. Solow and Edmond Thomas. The Nominating and Corporate Governance Committee held 2 meetings during the 2004 fiscal year. The Nominating Committee develops qualification criteria for Board members; interviews and screens individuals qualified to become Board members in order to make recommendations to the Board and oversees the evaluation of executive management. The Committee seeks to select a Board that is strong in its collective knowledge of and diversity of skills and experience concerning retail operations, accounting and finance, management and leadership, vision and strategy, risk assessment and corporate governance. The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee.

The Committee will consider nominations submitted by Shareholders. To recommend a nominee, a Shareholder should write to the Company's Secretary. To be considered by the Committee for nomination and inclusion in the Company's Proxy Statement for its 2006 Annual Meeting of Shareholders, a Shareholder recommendation for a Director must be received by the Company's Secretary no standing nominating committee. Mr. Higgins,later than January 15, 2006. Any recommendation must include (i) the name and address of the candidate, (ii) a brief biographical description, including his or her occupation for at least the last five years, and a statement of the qualifications of the candidate, taking into account the qualification requirements summarized above, and (iii) the candidate's signed consent to be named in the Proxy Statement and to serve as a Director if elected. The Committee may seek additional biographical and background information from any candidate that must be received on a timely basis to be considered by the Committee.

The process followed by the Committee to identify and evaluate candidates includes requests to Board members and others for recommendations, including a search firm or outside consultant, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Committee and the Board. Assuming the appropriate biographical and background material is provided for candidates submitted by Shareholders, the Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members. The Committee did not receive any nominations from Shareholders for the 2005 Annual Meeting.

During 2004, the Board created an ad hoc Concept Advisory Committee whose members during the 2004 fiscal year were: Mark A. Cohen, Martin E. Hanaka, and Edmond Thomas. The Concept Advisory Committee held 4 meetings during the 2004 fiscal year. The Concept Advisory Committee reviews and evaluates different store concepts for the Company within the entertainment industry.

The Board has established a process for Shareholders to communicate with members of the Board. The Chairman of the Nominating and Corporate Governance Committee, with the assistance of the Company's Secretary, will be primarily responsible for monitoring communications from Shareholders and providing copies or summaries of such communications to the other Directors, as he or she considers appropriate. Communications will be forwarded to all Directors if they relate to appropriate

matters and may include suggestions or comments from the Chairman of the Nominating and Corporate Governance Committee. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to personal grievances and matters as to which the Company tends to receive repetitive or duplicative communications. Shareholders who wish to send communications to the Board Chief Executive Officer and principal shareholder, was actively

involved in the recruitment of allmay do so by writing to:

Dr. Joseph G. Morone

Chairman of the current directors.

COMPENSATION OF DIRECTORS

COMPENSATION.Nominating and

Corporate Governance Committee

c/o the Company's Secretary

Trans World Entertainment Corporation

38 Corporate Circle

Albany, New York 12203.

Compensation of Directors

Cash Compensation. Each directorDirector who is not a salaried employee of the Company receives a $25,000 retainer per annum plus a $2,000 attendance fee for each board meetingBoard Meeting attended and a $1,000 attendance fee for each committee meeting attended, except that the compensation for telephone conference meetings is $500$1,000 and $250$500 for committee telephone conference meetings. A committee chairperson receives an additional $5,000 retainer per year and the Audit Committee chairperson earns an additional $2,000 retainer per year.receives a $15,000 annual retainer. The Company may, in its discretion, determine to pay all or a portion of any annual retainer in shares of Common Stock, in lieu of cash and to make other discretionary grants of Common Stock to non-employee directorsDirectors from time to time. The Company currently

pays the annual retainer in the form of stock.

DIRECTOR STOCK OPTION PLAN.

Directors Stock Option Plan. Each outside Director is entitled to participate in the Company's 1990 Stock Option Plan for Non-Employee Directors (the "Directors Stock Option Plan"). Currently, Messrs. Adler,Cohen, Dougan, Hanaka, Kaufman, Morone, Solow and SolowThomas participate in the Director Stock OptionDirectors Plan. A total of 750,000 shares of Common Stock are reserved for issuance pursuant to non-qualified stock options (the "Director Options") issued under such plan, and Director Options covering 557,438376,645 shares of Common Stock have been granted.granted and are outstanding. Stock options issuable under the Director Stock OptionDirectors Plan are granted at an exercise price equal to the fair market value of the Common Stock on the date of grant.

An initial grant of 15,000 Director Options is made to each new director.Director. In addition, Director Options to purchase 2,500on or about May 1 of each year, Directors receive grants of deferred shares of the Company's Common Stock are("Deferred Shares") under the Directors Plan representing $80,000 in market value of Common Stock as of the date of grant. However, the number of Deferred Shares granted annually on May 1 (or, if May 1 is not a Nasdaq National

Market trading day,may be no greater than 15,000. The Deferred Share grants vest on the next succeeding trading day)third anniversary of any yearthe date of grant. Prior to any

eligible director.March 15, 2005, each Director elected to either receive Common Stock upon vesting or defer the receipt of such Common Stock until such person is no longer a Director; provided that Deferred Shares will immediately vest and be distributed upon (1) the death or permanent disability of a Director or (2) certain events amounting to a sale or reorganization of the Company. The Board of Directors is authorized, in its discretion, to grant additional Director Options or Common Stock awards to Director Stock OptionDirectors Plan participants. All Director Options vest ratably over four years. During fiscal 2001,2004, annual grants to outside Directors of 15,000 Director Options62,080 Deferred Shares were made at an exercise

price of $8.95 per share, equalmade.

Retirement Plan. Prior to June 1, 2003 the market value on the date of grant.

RETIREMENT PLAN. The Company providesprovided the Board of Directors with a noncontributory, unfunded retirement plan that payspaid a retired directorDirector an annual retirement benefit equal to 60% of the annual retainer at the time of retirement plus a 3% annual increase through the final payment. Payments beginbegan at age 62 or retirement, whichever iswas later, and continuecontinued for 10 years or the life of the directorDirector and his or her spouse, whichever period is shorter. Partial vesting in the retirement plan beginsbegan after six years of continuous service. Participants becomebecame fully vested after 12 years of continuous service on the board.

RELATED PARTY TRANSACTIONSBoard.

Effective June 1, 2003, new Directors were not covered by the retirement plan. Directors who were not yet vested in their retirement benefits had the present value of benefits already accrued converted to Deferred Shares under the Directors Plan. Directors that were fully or partially vested in their retirement benefits on June 1, 2003 were given a one time election to continue to participate in the retirement program or convert the present value of benefits already accrued to Deferred Shares under the Directors Plan as of June 1, 2003.

Related Party Transactions

The Company leases its 168,000 square foot distribution center/office facility in Albany, New York from Robert J. Higgins, its Chairman, President, Chief Executive Officer and principal shareholder, under three capitalized leases that expire in the year 2015. The original distribution center/office facility was constructed in 1985. A 77,100 square foot distribution center expansion was completed in October 1989 on real property adjoining the existing facility. A 19,100 square foot expansion was completed in September 1998 adjoining the existing facility.

Under the three capitalized leases, dated April 1, 1985, November 1, 1989 and September 1, 1998 (the "Leases"), the Company paid Mr. Higgins an annual rent of $1.7$1.8 million in fiscal 2001.2004. On January 1, 2002,2004, the aggregate rental payment increased in accordance with the biennial increase in the Consumer Price Index, pursuant to the provisions of each lease. EffectiveThe next such increase will be effective January 1, 2004,2006, and occurs every

6

thereafter, the rental payment will increase in accordance with the

biennial increase in the Consumer Price Index, pursuant to the provisions of the

lease.thereafter. None of the leases contains any real property purchase option at the expiration of its term. Under the terms of the Leases, the Company pays all property taxes, insurance and other operating costs with respect to the premises. Mr. Higgins' obligation for principal and interest on his underlying indebtedness relating to the real property is approximately $1.1 million annually.

The Company leases twoone of its retail stores from Mr. Higgins under a long-term leases, one location haslease, with an annual rental of $40,000 and the other has an annual

rental of $35,000.$40,000. Under the terms of the leases,lease, the Company pays property taxes, maintenance and a contingent rental if a specified sales level is achieved. Total additional charges during fiscal 2001 for both locations2004 were $11,000, including rent.$14,500.

The Company regularly utilizes privately-chartered aircraft owned or partially owned by Mr. Higgins. Under an unwritten agreement with Quail Aero Services of Syracuse, Inc., a corporation in which Mr. Higgins is a one-third

shareholder,owns 47.5%, the Company paid $70,000$1,000 for chartered aircraft services in fiscal 2001.2004. The Company also charters an aircraft from Crystal Jet, a corporation wholly ownedwholly-owned by Mr. Higgins. During fiscal 2001,2004, payments to Crystal Jet aggregated $91,000.$10,000. The Company also charters an aircraft from Richmor Aviation, an unaffiliated corporation which leases an aircraft owned by Mr. Higgins. Payments to Richmor Aviation were $289,000$314,000 in 2001.2004. The Company believes that the charter rates and terms are as favorable to the Company as those generally available to it from other commercial charters.

The transactions that were entered into with an "interested director"Director" were approved by a majority of disinterested directorsDirectors of the Board of Directors, either by the Audit Committee or at a meeting of the Board of Directors. The

Board

Mark Higgins, the son of Directors believes that the leases and other provisions are at rates

and on terms that are at least as favorable as those that would have been

available toRobert J. Higgins was employed with the Company from unaffiliated third parties underas the circumstances.

TheDivisional Merchandise Manager—Video and Games. During 2004, Mark Higgins received $202,771 in cash compensation and was granted options to purchase 10,000 shares of Trans World stock. John Cave, the son-in-law of Robert J. Higgins was employed with the Company as an Operations Manager in the Albany Distribution Center. Mr. Cave received $60,186 in cash compensation and was granted options to purchase 2,000 shares of Trans World stock.

Prior to July 30, 2002, the Company made loans aggregating $442,717 to John J. Sullivan, the Company's Executive Vice President and Chief Financial Officer, in connection with income taxes due on restricted stock. The full principal amountAs of January 29, 2005 the loan was outstanding onfully satisfied.

Prior to July 30, 2002, the date hereof. The loan bears interest at a rate of 5.88%

per annum.

The Company made a loan in the amount of $258,405 to Bruce J. Eisenberg, the Company's Executive Vice President--RealPresident—Real Estate, in connection with income taxes due on restricted stock. The full principal amountAs of January 29, 2005 the loan was outstanding

on the date hereof. The loan bears interest at a rate of 5.88% per annum.fully satisfied.

Mr. Solow, a member of the Company's Board of Directors, is a partner of the law firm Kaye Scholer L.L.P.,LLP, which rendered legal services to the Company in 2001 and is expected2004 for which the Company incurred

fees of $115,000. Kaye Scholer concluded its representation of the Company in 2004, prior to provide legal servicesthe Company's 2004 Annual Shareholders meeting held in 2002.

EMPLOYMENT AGREEMENTSJune of 2004.

Employment Agreements

As founder and Chief Executive Officer of the Company, Robert J. Higgins has been instrumental in the operations of the Company. During fiscal 2001,2004, Mr. Higgins was employed as Chief Executive Officer and President of the Company pursuant to an employment agreement that commenced on May 3, 1998 and continuesis in effect until April 30, 2004,2008, unless earlier terminated pursuant to its terms. Pursuant to its terms, Mr. Higgins earns a minimum annual salary of $1,030,000,$1,200,000, with annual increases based on performance, as determined by the Compensation Committee, provided however that such increase shall not be less than the percentage amount, if any, by which the Consumer Price Index for All Urban Consumers (the "CPI") for all items for New York, New York as of April exceeds the CPI for the previous April. Effective May 1, 2005, Mr. Higgins' annual salary will be adjusted based on the year over year percentage increase in the CPI for the month of April. Mr. Higgins is reimbursed for two club memberships and is entitled to payment of or reimbursement for life insurance premiums of an amount which has an annual net after tax cost to the Company of up to $150,000 per year on insurance policies for the benefit of persons designated by Mr. Higgins. In addition, the Company must provide Mr. Higgins with an automobile and Mr. Higgins is eligible to participate in the Company's executive bonus plan, health and accident insurance plans, stock option plans and in other fringe benefit programs adopted by the Company for the benefit of its executive employees. For the fiscal year ended February 2, 2002,January 29, 2005, Mr. Higgins did not receive anyreceived $900,000 in incentive compensation under the employment agreement.

7

In the event of a change in control of the Company, Mr. Higgins may elect to serve as a consultant to the Company at his then current compensation level for the remainder of the term of the Employment Agreement or elect to receive 2.99 times his annual compensation in the most recently completed fiscal year. The employment agreement provides for no further compensation to Mr. Higgins if he is terminated for cause, as defined therein.

EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

COMPENSATION AND PURPOSE OF THE COMPENSATION COMMITTEE.

Compensation Committee Report on Executive Compensation

Compensation and Purpose of the Compensation Committee. The Company's Compensation Committee (the "Committee") was comprised during fiscal 20012004 of three non-employee directorsDirectors of the Company. Mr. Cohen was added to the Compensation Committee upon his appointment to the Board. It is the Company's policy to constitute the Committee with directorsDirectors that qualify as outside directorsDirectors under Section 162(m) of the Internal Revenue Code.

The Committee's purpose is to hire, develop and retain the highest quality managers possible. It is principally responsible for establishing and administering the executive compensation program of the Company. These duties include approving salary increases for the Company's key executives and administering both the annual incentive plan and stock option plans. COMPENSATION PHILOSOPHY AND OVERALL OBJECTIVES.Our decisions concerning the specific compensation elements and total compensation paid or awarded to senior executive officers, including the chief executive officer were made after consultation with an executive compensation expert. We also considered the balance between incentives for long-term and short-term performance, compensation paid to the executive's peers and the total compensation potentially payable to, and all of the benefits accruing to, the executive, including (1) supplemental executive pension plan benefits, (2) accumulated potential value of prior equity-based grants, and (3) the amount and type of perquisites. Specific decisions involving total senior executive officer compensation were based upon the Committee's judgment about the individual executive's performance and potential future contributions—and about whether each particular payment or award would provide an appropriate incentive and reward for performance that sustains and enhances long-term shareowner value.

Compensation Philosophy and Overall Objectives. The components of the executive compensation program are salary, annual incentive awards and stock options. This program is designed to: (1) attract and retain competent people with competitive salaries; (2) provide incentives for increased profitability; and (3) align the long-term interests of management with the interests of shareholders by encouraging executive ownership of Common Stock of the Company.

SALARY AND ANNUAL INCENTIVE COMPENSATION

SALARIES.Stock.

Salary and Annual Incentive Compensation

Salaries. The Committee believes that it is necessary to pay salaries that are competitive within the industry and geographic region in order to attract the types of executives needed to manage the business. Annual salary recommendations for the Company's executive officers (other than the Chief Executive Officer) are made to the Committee by the Chief Executive Officer. The Committee reviews and then approves, with any modifications it deems appropriate, such recommendations. Factors such as increased management responsibility and achievement of operational objectives are considered, but not formally weighted, in determining an increase. The Committee believes that it must keep the base pay component competitive to continue to attract competent management.

ANNUAL PERFORMANCE INCENTIVES.

Annual Performance Incentives. Key executives, including the named executive officers, were eligible for annual incentive (bonus) awards based on the performance of the Company against predetermined targets.

For 2001,2004, the Committee established as the principal goal a targeted level of operating income before bonuses would be paid to executive officers. Each named executive officer was eligible to earn from 17.5% to 150% of his salary in incentive payments if the targets were achieved by the Company. Below a certain target level no incentives were to be paid. Because the Company's operating income did not meetexceeded predetermined targets, noneeach of the named executives received annual incentive payments as outlined in the "SUMMARY COMPENSATION TABLE."

LONG-TERM INCENTIVES

Long-Term Incentives

The Committee uses a broad-based stock optionequity plan, with over 500 participants, as the principal long-term incentive for executives. The stock

optionequity plan is designed to encourage executive officers to become shareholders and to achieve meaningful increases in shareholder value. The Committee normally grants stock options to executive officers annually. The level of stock option grants is determined using a matrix that considers the executive's position, salary level, and performance as measured by the individual's performance rating.

8

The Company also has a restricted stock plan which the Committee may use to grant awards of Common Stock to officers and other key employees of the Company. The Committee believes that the Company's long-term goals are best achieved through long-term stock ownership. The level of awards is granted at the discretion of the Committee.

CHIEF EXECUTIVE OFFICER'S COMPENSATION

Chief Executive Officer's Compensation

The Chief Executive Officer was compensated in fiscal 20012004 pursuant to an employment agreement, approved by the Committee, which will be in effect through April 30, 2004. Mr. Higgins'2008. The Chief Executive Officer's base annual compensation, pursuant to the agreement, is $1,030,000$1,200,000 with annual increases based on performance, as determined by the compensation committee.Committee, provided however that such increase shall not be less than the percentage amount, if any, by which the Consumer Price Index for All Urban Consumers (the "CPI") for all items for New York, New York as of April exceeds the CPI for the previous April. The employment agreement provides for participation in the management bonus plan at a level of 0% to a maximum of 150% of his salary if certain targets are achieved by the Company. DEDUCTIBILITY OFBecause the Company's operating income exceeded predetermined targets, the Chief Executive Officer received an annual incentive payment as outlined in the "SUMMARY COMPENSATION EXPENSESTABLE."

Deductibility of Compensation Expenses

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to a public corporation for annual compensation over $1 million for its chief

executive officerChief Executive Officer or any of its four other highest paid executive officers. Qualifying performance based compensation will not be subject to the deduction limit if certain requirements are met. The Committee believes that it is necessary to pay salaries that are competitive within the industry and geographic region in order to continue to attract the types of executives needed to manage the business. Executive compensation is structured to avoid limitations on deductibility where this result can be achieved consistent with the Company's compensation goals.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Compensation Committee Interlocks and Insider Participation

There were no Compensation Committeecompensation committee interlocks during fiscal 2001.2004. None of thesethe Committee's members was an officer or employee of the Company, a former officer of the Company, or a party to any relationship requiring disclosure under Item 404 of Regulation S-K underS-K.

Compensation Committee of the Securities Exchange ActBoard of 1934, as amended.

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

MARTINDirectors

Martin E. HANAKA, CHAIRMAN

GEORGEHanaka, Chairman

Mark A. Cohen

George W. DOUGAN

ISAAC KAUFMAN

- ------------------------

Dougan

Isaac Kaufman

Notwithstanding anything to the contrary set forth in the Company's previous filings under the Securities Act of 1933 or under the Securities Exchange Act of 1934 that might incorporate future filings, including this Proxy Statement, in whole or in part, the preceding report of the Compensation Committee and the performance graph below shall not be incorporated by reference to such filings.

EXECUTIVE OFFICERS AND COMPENSATION

Executive Officers and Compensation

The Company's executive officers (other than Mr. Higgins whose biographical information is included under "Election of Directors" herein) are identified below. At year end, threefour officers met the definition of "executive officer" under applicable regulations for the fiscal year 2001,2004, including the Chief Executive Officer. Executive officers of the Company currently hold the same respective positions with Record Town, Inc., the Company's wholly-owned subsidiary through which all retail operations are conducted.

JOHN

Bruce J. SULLIVAN has been Executive Vice President, Treasurer and Chief

Financial Officer of the Company since May 2001. Mr. Sullivan joined the Company

in June 1991 as the Corporate Controller and was named Vice President of Finance

and Treasurer in June of 1994 and Senior Vice President of Finance, Chief

Financial Officer and Treasurer in May 1995. Prior to joining the Company,

Mr. Sullivan was Vice President and Controller for Ames Department Stores, a

discount department store chain.

9

BRUCE J. EISENBERGEisenbergseniorSenior Vice President of Real Estate in May 1995. Prior to joining the Company, Mr. Eisenberg was responsible for leasing, finance and construction of new regional mall development at The Pyramid Companies.

Fred L. Fox has been Executive Vice President of Merchandising and Marketing at the Company since February 2002. Prior to joining Trans World, Mr. Fox held several key executive level positions within OfficeMax and Montgomery Ward as well as various management positions within Circuit City Incorporated, Target Stores and Fischer Scientific Company, LLC.

John J. Sullivan has been Executive Vice President, Secretary and Chief Financial Officer of the Company since May 2002. Mr. Sullivan joined the Company in June 1991 as the Corporate Controller and was named Vice President of Finance and Treasurer in June of 1994, Senior Vice President of Finance, Treasurer and Chief Financial Officer in May 1995 and Executive Vice President, Treasurer and Chief Financial Officer in May 2001. Prior to joining the Company, Mr. Sullivan was Vice President and Controller for Ames Department Stores, a discount department store chain.

The Summary Compensation Tablesummary compensation table sets forth the compensation paid by the Company and its subsidiaries for services rendered in all capacities during the last three fiscal years to the Chief Executive Officer and each of the three executive officers of the Company whose cash compensation for that year exceeded $100,000 (the "Named Executive Officers").

SUMMARY COMPENSATION TABLE

LONG-TERM

COMPENSATION

AWARDS

ANNUAL COMPENSATION -----------------------

----------------------------------- RESTRICTED SECURITIES

OTHER ANNUAL STOCK UNDERLYING ALL OTHER

SALARY BONUS COMPENSATION AWARD(S) OPTIONS/ COMPENSATION

NAME AND PRINCIPAL POSITION YEAR ($) ($) ($) ($) SARS(#) ($)

- --------------------------- -------- --------- -------- ------------ ---------- ---------- ------------

Robert J. Higgins................ 2001 1,030,000 -- 260,877(1) 196,900 500,000 5,274(3)

Chairman and Chief 2000 956,731 -- 230,335(1) -- 500,000 7,096(3)

Executive Officer 1999 712,500 425,000 91,254(1) -- 200,000 5,625(3)

Bruce J. Eisenberg............... 2001 287,495 -- --(2) 89,500 50,000 5,581(3)

Executive Vice President-- 2000 251,058 -- --(2) -- 50,000 5,620(3)

Real Estate 1999 227,500 50,000 --(2) -- 75,000 5,414(3)

John J. Sullivan................. 2001 287,495 -- --(2) 89,500 50,000 5,581(3)

Executive Vice President and 2000 251,058 -- --(2) -- 50,000 5,503(3)

Chief Financial Officer 1999 227,500 41,125 --(2) -- 75,000 9,234(3)

- ------------------------

| | | | | | Long-Term Compensation Awards | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | |||||||||||||

| | | Restricted Stock Award(s) ($) | Securities Underlying Options/ SARs (#) | | ||||||||||||

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Other Annual Compensation ($) | All Other Compensation ($) | |||||||||||

| Robert J. Higgins | 2004 | 1,200,000 | 900,000 | 171,201 | (1) | — | 550,000 | 6,681 | (4) | |||||||

| Chairman and Chief | 2003 | 1,116,000 | 1,674,000 | 160,479 | (1) | — | 1,000,000 | 6,323 | (4) | |||||||

| Executive Officer | 2002 | 1,066,000 | — | 201,974 | (1) | — | 550,000 | 6,670 | (4) | |||||||

Bruce J. Eisenberg | 2004 | 327,500 | 132,000 | — | (2) | — | 60,000 | 12,767 | (4) | |||||||

| Executive Vice President— | 2003 | 317,625 | 320,000 | — | (2) | — | 150,000 | 6,061 | (4) | |||||||

| Real Estate | 2002 | 307,875 | — | — | (2) | — | 60,000 | 5,457 | (4) | |||||||

Fred L. Fox | 2004 | 317,500 | 128,000 | — | (2) | — | 60,000 | 923 | (4) | |||||||

| Executive Vice President— | 2003 | 307,500 | 310,000 | 75,096 | (3) | — | 150,000 | — | ||||||||

| Merchandising and Marketing | 2002 | 280,385 | — | — | (2) | — | 150,000 | — | ||||||||

John J. Sullivan | 2004 | 332,577 | 132,000 | — | (2) | — | 60,000 | 12,767 | (4) | |||||||

| Executive Vice President, Secretary | 2003 | 321,207 | 320,000 | — | (2) | — | 150,000 | 6,283 | (4) | |||||||

| and Chief Financial Officer | 2002 | 307,875 | — | — | (2) | — | 60,000 | 5,815 | (4) | |||||||

- (1)

"Other - "Other Annual Compensation" in fiscal

2001, 20002004, 2003 and19992002 for Mr. Higgins includes$237,837, $212,658,$150,000, $150,000, and$82,117,$154,755, respectively, in payments for, or reimbursement of, life insurance premiums made on behalf of Mr. Higgins or his beneficiaries, pursuant to his employment agreement.It also includes a maximum dollar value of premiums paid by the Company with respect to split dollar life insurance policies that the Company owns on the lives of Mr. Higgins and his wife. The Company will recoup most or all of such premiums upon maturity of the policies, but the maximum potential value is calculated in line with current SEC instructions as if the premiums were advanced without interest until the time that the Company expects to recover the premium. - (2)

"Other - "Other Annual Compensation" for the named executive was less than $50,000 and also less than 10% of the total annual salary and bonus reported.

- (3)

"All - "Other Annual Compensation" for the named executive was for relocation expenses.

- (4)

- "All Other Compensation" for the named executive consists of employer matching contributions for the 401(k) Savings Plan.

STOCK OPTION PLANS

Stock Option Plans

The Company has fivesix employee stock option plans with an aggregate of 10,800,00014,800,000 shares (collectively referred to as the "Stock Option Plan"). Stock Optionsoptions are exercisable annually in 4 equal installments, commencing on the first anniversary of the date of the grant. The stock options have a term of ten years. All options granted under the Stock Option Plan may become immediately exercisable upon the occurrence of certain business combinations. The Compensation Committee of the Board of Directors may accelerate or extend the term of any options subject to such terms and conditions as the Compensation Committee deems appropriate. The option exercise price was set at the fair market value (last reported sale price) on the date of grant. The following tables set forth, as to each of the 10

named executive officers,Named Executive Officers, certain information with respect to all options granted or exercised for the fiscal year ended February 2, 2002,January 29, 2005, under the Stock Option Plan.

STOCK OPTION GRANTS IN LAST FISCAL YEAR

The following table sets forth information concerning individual grants of stock options made during the fiscal year ended February 2, 2002,January 29, 2005, to each of the Named Executive Officers.

| | Individual Grants | | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) | ||||||||||||||

| | Number of Securities Underlying Options Granted (#) | Percent of Total Options Granted to Employees in Fiscal Year | | | |||||||||||

| Name | Exercise or Base Price Per Share | Expiration Date | |||||||||||||

| 5% | 10% | ||||||||||||||

| Robert J. Higgins | 550,000 | 42.3 | % | $ | 10.31 | 5/1/2014 | $ | 5,331,054 | $ | 11,847,637 | |||||

| Bruce J. Eisenberg | 60,000 | 4.6 | % | $ | 10.31 | 5/1/2014 | 581,570 | 1,292,469 | |||||||

| Fred L. Fox | 60,000 | 4.6 | % | $ | 10.31 | 5/1/2014 | 581,570 | 1,292,469 | |||||||

| John J. Sullivan | 60,000 | 4.6 | % | $ | 10.31 | 5/1/2014 | 581,570 | 1,292,469 | |||||||

- (1)

- These amounts are based on assumed appreciation rates of 5% and 10% as prescribed by the Securities and Exchange Commission rules, and are not intended to forecast possible future appreciation, if any, of the Company's stock price. The Company's stock price was

$7.83$12.28 atFebruary 2, 2002,January 29, 2005, the fiscal year end.

On May 1, 2003, stock options representing 1,000,000 shares of Common Stock were granted to Mr. Higgins subject to the following vesting arrangement: options representing 500,000 shares will vest over a 4-year period and options representing 500,000 shares will vest pursuant to a 5-year cliff vesting arrangement with a performance accelerator clause. The performance acceleration will apply at such time as Mr. Higgins recommends, and the Board of Directors approves, a successor Chief Executive Officer for Trans World Entertainment Corporation. If a successor Chief Executive Officer is hired before the 5-year cliff vesting is satisfied, the 500,000 shares vest in full.

AGGREGATED STOCK OPTION EXERCISES IN LAST FISCAL

YEAR AND FISCAL YEAR-END OPTION VALUES

The following table sets forth information concerning each exercise of stock options made during the fiscal year ended February 2, 2002,January 29, 2005, by each of the named

executive officersNamed Executive Officers of the Company, and the value of unexercised stock options held by such person as of February 2, 2002.

| | | | Number of Securities Underlying Unexercised Options at Fiscal Year End (#) | Value of Unexercised In-the-Money Options at Fiscal Year End ($) | |||||

|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | Exercisable/ Unexercisable | Exercisable/ Unexercisable(1) | |||||

| Robert J. Higgins | — | — | 1,737,500/1,862,500 | $ | 5,192,250/$10,353,750 | ||||

| Bruce J. Eisenberg | 78,000 | 742,030 | 353,750/263,750 | 1,867,438/1,522,113 | |||||

| Fred L. Fox | — | — | 75,000/285,000 | 458,500/1,693,700 | |||||

| John J. Sullivan | 195,000 | 1,879,857 | 263,750/263,750 | 904,738/1,522,113 | |||||

- (1)

- Calculated on the basis of the fair market value of the underlying securities as of

February 2, 2002January 29, 2005, minus the exercise price.11

Supplemental Executive Retirement Plan

The Company maintains a non-qualified Supplemental Executive Retirement Plan ("SERP") for certain executive officers of the Company. The SERP, which is unfunded, provides eligible executives defined pension benefits that supplement benefits under other retirement arrangements. The annual benefit amount is equal to 50% of the average of the participant's base compensation for the five years prior to retirement plus the average of the three largest bonus payments for the last five years prior to retirement, to the extent vested. The following table illustrates the total combined estimated annual benefits payable under the Supplemental Executive Retirement Plan:

| | Years of Service(1) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Remuneration(2) | ||||||||||

| 15 | 20 | 25 | 30 | 35 | ||||||

| 125,000 | 21,875 | 46,875 | 46,875 | 46,875 | 46,875 | |||||

| 150,000 | 26,250 | 56,250 | 56,250 | 56,250 | 56,250 | |||||

| 175,000 | 30,625 | 65,625 | 65,625 | 65,625 | 65,625 | |||||

| 200,000 | 35,000 | 75,000 | 75,000 | 75,000 | 75,000 | |||||

| 225,000 | 39,375 | 84,375 | 84,375 | 84,375 | 84,375 | |||||

| 250,000 | 43,750 | 93,750 | 93,750 | 93,750 | 93,750 | |||||

| 300,000 | 52,500 | 112,500 | 112,500 | 112,500 | 112,500 | |||||

| 400,000 | 70,000 | 150,000 | 150,000 | 150,000 | 150,000 | |||||

| 450,000 | 78,750 | 168,750 | 168,750 | 168,750 | 168,750 | |||||

| 500,000 | 87,500 | 187,500 | 187,500 | 187,500 | 187,500 | |||||

- (1)

- For a participant to vest 100%, they must have at least 20 years of service and work with the Company until age 65.

- (2)

- The compensation levels above are based on the average salary, as provided under the title "Salary" in the Summary Compensation table, for the last five years of employment. If the participant works until age 65, the benefit will be adjusted to include the average of the three largest bonus payouts during the last five years of employment.

Currently, Robert J. Higgins is a participant in this plan and his salary differs from those used in the compensation table. At his current salary, $1,200,000, Mr. Higgins would receive a benefit of $600,000.

The following is a table of current participants and their years of credited service:

| Participant | Years of Service | |

|---|---|---|

| Robert J. Higgins | 32 | |

| Mitch Davis | 4 | |

| Bruce J. Eisenberg | 11 | |

| Fred Fox | 3 | |

| John J. Sullivan | 13 |

The benefits above are not to subject to any deductions or offset amounts.

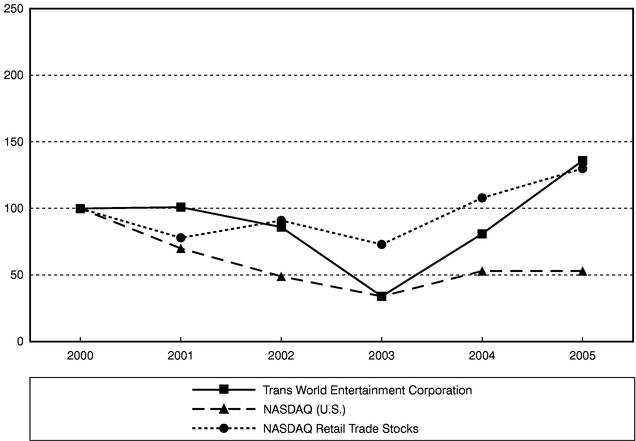

The following line graph reflects a comparison of the cumulative total return of the Company's Common Stock from January 31, 19972000 through January 31,

200229, 2005 with the Nasdaq Index (U.S. Stocks) and with the Nasdaq National Market Retail Trade Stocks index. Because only one of the Company's leading competitors has been an independent publicly traded company over the period, the Company has elected to compare shareholder returns with the published index of retail companies compiled by NASDAQ. All values assume a $100 investment on January 31, 1997,2000, and that all dividends were reinvested.

EDGAR REPRESENTATION OF DATA POINTS USED IN PRINTED GRAPHIC

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Trans World Entertainment Corporation | 100 | 101 | 86 | 34 | 81 | 136 | ||||||

| NASDAQ (U.S.) | 100 | 70 | 49 | 34 | 53 | 53 | ||||||

| NASDAQ Retail Trade Stocks | 100 | 78 | 91 | 73 | 108 | 130 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE WITH SECTION 16(A) OF THE SECURITIES EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934 generally requires the Company's directors,Directors, executive officers and persons who own more than ten percent of the registered class of the Company's equity securities to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission. Based solely upon its review of the copies of such reports received by it, or upon written representations obtained from certain reporting persons, the Company believes that all Section 16(a) filing requirements applicable to its officers, directors,Directors, and greater-than-ten-percentgreater than ten percent stockholders were complied with.

12

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board has reviewed and discussed the Company's audited financial statements with the management of the Company. The Audit Committee has discussed with KPMG LLP, the Company's independent auditors,accountants, the matters required to be discussed by Statement on Auditing Standards 61. The Audit Committee also has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees) and has discussed with KPMG LLP the independence of such independent accounting firm. The Committee has also considered whether the independent auditors'accountants' provision of information technology and other non-audit services to the Company is compatible with the auditors'accountants' independence. Based on its review and discussions referred to in the preceding paragraph,above, the Audit Committee recommended to the Board that the audited financial statements for the fiscal year ended February 2, 2002January 29, 2005 be included in the Company's Annual Report on Form 10-K for the Company's fiscal year ended February 2, 2002.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

ISAAC KAUFMAN (CHAIRMAN)

MICHAEL SOLOW

JOSEPH MORONE

January 29, 2005.

Audit Committee of the Board of Directors

Isaac Kaufman (Chairman)

Michael B. Solow

Dr. Joseph G. Morone

Edmond Thomas

OTHER MATTERS

OTHER ITEMS.

Other Items. Management knows of no other items or matters that are expected to be presented for consideration at the meeting. If other matters properly come before the meeting, however, the persons named in the accompanying proxy intend to vote thereon in their discretion.

PROXY SOLICITATION.

Proxy Solicitation. The Company will bear the cost of the meeting and the cost of soliciting proxies, including the cost of mailing the proxy materials. In addition to solicitation by mail, directors,Directors, officers, and regular employees of the Company (none of whom will be specifically compensated for such services) may solicit proxies by telephone or otherwise. Arrangements will be made with brokerage houses and other custodians, nominees, and fiduciaries to forward proxies and proxy materials to their principals, and the Company will reimburse them for their ordinary and necessary expenses.

INDEPENDENT AUDITORS.

Independent Accountants. The Board of Directors currently intends to select KPMG LLP as independent auditorsaccountants for the Company for the fiscal year ending February 1, 2003.January 28, 2006. KPMG LLP has acted as auditorsaccountants for the Company since 1994.1994, when it purchased the Albany practice of Ernst & Young, the Company's accountants since 1985. Representatives of KPMG LLP will be present at the Annual Meeting of Shareholders and available to make statements to and respond to appropriate questions of shareholders.

The appointment of independent accountants is approved annually by the Board of Directors. The decision of the Board is based on the recommendation of the Audit Committee, which reviews and approves in advance the audit scope, the types of nonauditnon-audit services, and the estimated fees for the coming year. The committeeAudit Committee also reviews and approves nonauditnon-audit services to ensure that they will not impair the independence of the accountants.

Before making its recommendation to the Board for appointment of KPMG LLP, the audit committeeAudit Committee carefully considered that firm's qualifications as independent accountants for the Company. This included a review of its performance in prior years, as well as its reputation for integrity and competence in the fields of accounting and auditing. The committeeAudit Committee has expressed its satisfaction with KPMG LLP in all of these respects. The Audit Committee's review included inquiry concerning any litigation involving KPMG LLP and any proceedings by the Securities and Exchange Commission (the "SEC") against the firm. In this respect, the committeeAudit Committee has concluded that the ability of KPMG LLP to perform services for the Company is in no way adversely affected by any such investigation or litigation. 13

AUDIT FEES.The following is a description of the fees billed to the Company by KPMG LLP for fiscal years 2004 and 2003.

Audit Fees. Audit fees include fees paid by the Company to KPMG LLP in connection with the annual audit of the Company's consolidated financial statements and KPMG LLP's review of the Company's interim financial statements. Audit fees also include fees for services performed by KPMG LLP that are closely related to the audit and in many cases could only be provided by independent accountants. Such services include comfort letters and consents related to SEC registration statements and certain reports relating to the Company's regulatory filings. The aggregate fees billed for professional services rendered

forto the audit of the Company's annual financial statement for the fiscal year

ended February 2, 2002, and for the reviews of the financial statements included

in the Company's Quarterly Reports on Form 10-Q for that fiscal year were

$252,720.

FINANCIAL INFORMATION SYSTEMS DESIGN AND IMPLEMENTATION FEES. KPMG LLP did

not render professional services relating to financial information system design

and implementation for the fiscal year ended February 2, 2002.

ALL OTHER FEES. The aggregate fees billedCompany by KPMG LLP for audit services rendered to the Company other thanand its subsidiaries for fiscal years 2004 and 2003 totaled $850,000 and $281,578, respectively. The increase in 2004 fees was primarily related to services in connection with Section 404 of the Sarbanes-Oxley Act of 2002.

Audit Related Fees. Audit related services described above under "Audit Fees"include due diligence and audit services related to employee benefit plan audits and certain attest services. The aggregate fees billed to the Company by KPMG LLP for audit related services rendered to the Company and its subsidiaries for fiscal years 2004 and 2003 totaled $16,000 and $10,000, respectively.

Tax fees. Tax fees include corporate tax compliance and counsel and advisory services. The aggregate fees billed to the Company by KPMG LLP for tax related services rendered to the Company and its subsidiaries for fiscal years 2004 and 2003 totaled $263,000 and $127,689, respectively. Deloitte and Touche LLP will be the Company's primary tax advisor in 2005.

Each year, ended February 2, 2002 were $338,088.

FINANCIAL STATEMENTS.the Company reviews its existing practices regarding the use of its independent accountants to provide non-audit and consulting services, to ensure compliance with recent SEC proposals. The Company has a policy which provides that the Company's independent accountants may provide certain non-audit services which do not impair the accountants' independence. In that regard, the Audit Committee must pre-approve all audit services provided to the Company, as well as non-audit services provided by the Company's independent accountants. This policy is administered by the Company's senior financial management, which reports throughout the year to the Audit Committee.

Financial Statements. The Company's 20012004 Annual Report to Shareholders (which does not form a part of the proxy solicitation material), including financial statements for the fiscal year ended February 2, 2002January 29, 2005 is being sent concurrently to shareholders. If you have not received or had access to the 20012004 Annual Report to Shareholders, please write the Company to attention of:you may request a copy by writing to: Trans World Entertainment, Attention: Treasurer, 38 Corporate Circle, Albany, New YorkNY 12203, and a copy will be sent to you free of charge.

ITEM

Item 2. APPROVAL OF 2002 STOCK OPTIONTHE 2005 LONG TERM INCENTIVE AND SHARE AWARD PLAN

INTRODUCTION

The Board of Directors is seekinghas adopted the 2005 Long Term Incentive and Share Award Plan (the "Plan"), subject to shareholder approvalapproval. We now ask the shareholders to approve the adoption of the 2002Plan. The following summary of the Plan is qualified in its entirety by reference to the Plan, which is attached as Appendix A to this Proxy Statement.

General. The Plan is intended to provide incentives to attract, retain and motivate employees, consultants and Directors and to provide for competitive compensation opportunities, to encourage long term service, to recognize individual contributions and reward achievement of performance goals, and to promote the creation of long term value for stockholders by aligning the interests of such persons with those of stockholders. The Plan will provide for the grant to eligible employees, consultants and Directors of stock options, share appreciation rights ("SARs"), restricted shares, restricted share units, performance shares, performance units, dividend equivalents, and other share-based awards (the "Awards"). An aggregate of 5,000,000 shares of Common Stock Optionhave been reserved for issuance under the Plan. In addition, during a calendar year (i) the maximum number of shares with respect to which options and SARs may be granted to a participant under the Plan (the "2002 Plan"),will be 1,000,000 shares, and (ii) the maximum number of shares which will succeedmay be granted to a participant under the existing stock option

plan. The new plan was draftedPlan with respect to comply with the regulations issuedAwards intended to qualify as performance-based compensation under

Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") (other than options and SARs) will be 200,000 shares. These share amounts are subject to ensure the

tax deductibility of compensation paid.

The purpose of the Company's stock option programs is to provide a flexible

mechanism to permit employees to obtain significant equity ownershipanti-dilution adjustments in the Company, giving them a permanent stakeevent of certain changes in the Company's growth and success, and

encouraging the continuation of their involvement with the Company. The

Compensation Committee has recommendedcapital structure, as described below. Shares issued pursuant to the BoardPlan will be authorized but unissued shares.

The Company currently awards stock options and restricted shares to associates through the 1990 Restricted Stock Plan, 1998 Stock Option Plan, the 1999 Stock Option Plan and the 2002 Stock Option Plan (the "Current Plans"). As of Directors that a stock

option program shouldMay 2, 2005, the Company has an aggregate of approximately 1,150,000 shares remaining for future awards under the Current Plans.No further awards will be continued. On March 15, 2002,made pursuant to the Board of Directors

adopted, subject toCurrent Plans upon shareholder approval of the 2002Plan.

Eligibility and Administration. Directors, Officers and other employees of, and consultants to, the Company and its subsidiaries and affiliates and Directors of the Company will be eligible to be granted Awards under the Plan. The following summary describes the principal features of the 2002 Plan and

compares the terms of the 2002 Plan to those of the 1999 Plan. This summary is

qualified in its entirety by reference to specific provisions of the 2002 Plan

set forth in Annex A.

THE 2002 PLAN

COMMITTEE. The 2002 Plan will be administered by the Compensation Committee or such other Board committee appointed(or the entire Board) as may be designated by the Board of Directors, consisting(the "Committee"). Unless otherwise determined by the Board, the Committee will consist of two or more directors. Each membermembers of the Committee will be a "non-employee director" as

defined inBoard who are nonemployee Directors within the meaning of Rule 16b-3 promulgated underof the Securities Exchange Act of 1934 as

amended (the "Exchange Act"), and an "outside director" as defined in

regulations issued underDirectors" within the meaning of Section 162(m) of the Internal Revenue CodeCode. The Committee will determine which eligible employees, consultants and Directors receive Awards, the types of 1986, as

amended.

ELIGIBILITY. Executive officers, managementAwards to be received and other employees (including

officersthe terms and employees who may be directors)conditions thereof. The Committee will have authority to waive conditions relating to an Award or accelerate vesting of the Company and of any

subsidiary shall beAwards. Approximately 8,000 persons are currently eligible to participate in the 2002 Plan. Selection of

employees eligiblePlan, but awards are generally limited to participateapproximately 500 upper level associates.

Awards. Incentive stock options ("ISOs") intended to qualify for special tax treatment in accordance with the 2002 Plan is within the discretion of

the Committee. It is expected that the 2002 Plan will be administered in a

manner similar to the 1994, 1998Code and 1999 Plans, in which approximately 600

employees currently participate.

COMMON STOCK ISSUABLE UPON EXERCISE. Under the 2002 Plan, up to 4,000,000

shares of the Company's Common Stock may be optioned or granted to eligible

employees, and no more than 750,000nonqualified stock options not intended to qualify for special tax treatment under the Code may be granted to any one

employee during any calendar year during the term of the plan. Shares of the

Company's Common Stock that are optioned or awarded under the 2002 Plan may be

either treasury shares or authorized but unissued shares. Shares reserved for issuance pursuant

14

to expired or terminated options under the 2002 Plan will be made available for

future option grants under the 2002 Plan.

The 2002 Plan provides for appropriate adjustments in the aggregatesuch number of shares of Common Stock subjectas the Committee determines. The Committee will be authorized to such plan and inset the number of sharesterms relating to an option, including exercise price and the price per share, or either,time and method of outstanding options in the case of changes in

the capital stock of the Company resulting from any stock dividend, stock split,

reverse split, subdivision or combination of shares resulting in an increase or

decrease of those outstanding shares of Common Stock. If the Company is merged

or consolidated with another corporation, or if substantially all of the

property, stock or assets of the Company are to be acquired by another

corporation, or if a separation, reorganization, or liquidation of the Company

occurs, then the Board of Directors shall either (i) make appropriate provisions

for the protection of any outstanding options by the substitution on an

equitable basis of cash or comparable stock or stock options or (ii) make a cash

payment equal to the difference betweenexercise. However, the exercise price of all vested options and the fair market value of the Common Stock on the date of such transaction,

as determined by the highest sales price of the Common Stock quoted by the

exchange on which it is traded.

GRANTS OF STOCK OPTIONS AND STOCK APPRECIATION RIGHTS. Under the 2002 Plan,

the Committee may grant to eligible employees either non-qualified or incentive

stock options, or both, to purchase shares of the Company's Common Stock. The

Committee may also provide that options maywill not be exercised in whole or in part

for any period or periods of time. The number of shares covered by incentive

stock options which may be first exercised by an optionee in any year cannot